To start a Texas LLC, you’ll need to file a Certificate of Formation with the Secretary of State and pay state filing fees. But state forms and fees alone won’t help you run your business and connect with customers.

That’s why business owners hire us. When you choose Lone Star Registered Agent, you get everything you need to launch and grow your business:

- Free Texas business address

- Free basic mail scanning

- Free domain + website + email (90 days)

- Expert customer support for the lifetime of your business!

Complete Guide to LLC Formation in Texas

Want to form your business on your own? Just hire us for registered agent service and follow these 5 steps:

How to Form an LLC in Texas

Forming an LLC in Texas requires filing a Certificate of Formation with the Texas Secretary of State and paying the state filing fee of $300 (around $310 online). The most difficult part of filing? Ensuring you set your LLC up right to maximize all the benefits of a Limited Liability Company in the Texas.

The easiest way to make sure you get your company set up right the first time is to hire us to form your LLC! But if you’d rather take care of it on your own, here are the 5 steps you should follow:

1. Choose Your Texas LLC Name

The first step to starting your Texas LLC is choosing a name for your business. You can choose pretty much any LLC name so long as it follows the naming requirements:

- Your company name must be distinguishable

- Your company name must have an organizational identifier, like “limited liability company” (or an acceptable abbreviation of the term)

- Use only acceptable symbols: ! ” $ % ‘ ( ) * ? # = @ [] / + & and –

- Do NOT use words that suggest government affiliation or a business purpose you cannot lawfully fulfill (like “insurance” or “bail bond”)

- Avoid restricted words, for example: “Olympic,” “University,” “trust,” or “veteran”

- Foreign words ARE considered distinguishable, even if they translate to a business name that’s already in use

- Do NOT use an offensive name (this is left up to your good judgment)

You can find a full list of requirements in the Texas Administrative Code.

How do I know if my Texas business name is available?

You can check if your Texas business name is available through the Texas Taxable Entity Search.

What if my LLC name gets rejected?

If your name doesn’t pass muster on your first go around, not only will you have lost the time it took to complete your documents the first time, you’ll have to pay another formation fee of $300. And then you’re back to square: picking a name for your LLC.

How can I reserve an LLC name in Texas?

You can submit Form 501, the Application for Reservation or Renewal of Reservation of an Entity Name. The form costs $40 and reserves your entity name for 120 days. Name reservations may also be renewed.

Can I change the name of my LLC in Texas?

Yes, you can change the name of your LLC in Texas by filing Form 424 and paying a $150 fee.

2. Appoint Your Registered Agent

Your registered agent is the person or company who receives service of process on behalf of your business then delivers those documents to you in a timely manner. Service of process can refer to lawsuits, subpoenas, or any other document generated by a court of law.

In addition to legal mail, your registered agent will also accept official notices from the state. So it’s highly important to choose a registered agent with a proven track record of reliability.

Can I be my own registered agent in Texas?

You can act as your own registered agent, or you can hire a company to do it. The individual or company you hire must:

- Maintain a physical address in the state of Texas

- Be present at that office during normal business hours

- Agree to deliver all service of process to you shortly after it is received

Keep in mind that if you act as your own registered agent, your information will become part of the public record. Hiring the right professional Texas registered agent can keep your personal information off state filings

How does a registered agent protect my privacy?

A registered agent protects your privacy by using their business address on your Texas LLC’s public filings instead of your home address. This keeps your personal information off the public record and prevents unwanted mail or visitors from showing up at your doorstep.

When you hire Lone Star to start your business, we serve as your registered agent and list our business address instead of yours. We also provide you all the tools to keep your business and private life separate: basic mail forwarding, a virtual office that gives you an office lease, and local phone number.

How do I change my registered agent in Texas?

Simply file Form 401, aka the Statement of Change of Registered Office/Agent form with the Texas Secretary of State’s office. There is a $15 filing fee. Processing takes three to five business days with the SOS but can be expedited for $25.

Want to form your LLC on your own? You can still hire us to be your registered agent.

3. File a Certificate of Formation

A Certificate of Formation, known in Texas as Form 205, is simply the document that officially forms your Texas LLC. To complete your certificate, you will need to provide your LLC name and registered agent information, as well as the following:

- Business Name: Don’t forget to include LLC, Limited Liability Company or a similar identifier.

- Registered Office and Agent: The street address in Texas and the dedicated person who accepts legal mail there.

- Governing Authority: Whether your LLC is managed by members (all the owners) or managers (people appointed or hired to run the LLC).

- Purpose: The nature of your business (Optional).

- Organizer: The organizer is the person or business who files your Certificate of Formation.

- Effectiveness of Filing: The date your LLC will start. Future dates must be within 90 days of approval.

If filing online, you will be prompted to pay your e-filing fee of $308.10 ($300 plus a 2.7% processing fee). If filing by mail, file in duplicate and include a check or money order for $300.

How do I file a Certificate of Formation in Texas?

File online at:

SOSDirect

Send by mail to:

Secretary of State

P.O. Box 13697

Austin, Texas 78711-3697

Deliver in person to:

James Earl Rudder Office Building

1019 Brazos

Austin, Texas 78701

Once payment is approved, your Certificate of Formation has been submitted! Congratulations!

4. Obtain Your EIN Tax ID

The majority of LLCs are required to have an Employer Identification Number (EIN). An EIN is essentially your company’s Social Security number. The IRS uses this nine-digit number to easily identify the business on tax filings. In order pay employees and claim profits on your federal taxes, you will need an EIN number.

How do I get an EIN for my Texas business?

Getting an EIN tax ID for your company can be done at the IRS website, or you can hire us to do it.

5. Create a Texas LLC Operating Agreement

Texas business laws do not require LLCs to have an operating agreement, but you should consider it a necessity. The operating agreement is a document that outlines the entity’s rules, regulations, and provisions, along with how those encapsulate the business’ financial and functional directions.

If your company has multiple owners, your Texas LLC operating agreement can be used to govern owners’ disputes down the road. When you hire Lone Star Registered Agent to form your LLC for you, we include an LLC operating agreement.

Do I need an operating agreement in Texas for a single-member LLC?

With single-member LLCs, the operating agreement is vital to showing how the LLC is actually an organized legal entity. This makes it harder to apply an LLC’s possible liability or debts to an individual.

What should I include in my Texas LLC operating agreement?

- The purpose and duration of the company

- Process for adding members

- Procedures for member deaths/absences

- Members’ names, addresses and contributions

- Distribution of profits and losses

- Management responsibilities and powers

- Indemnification policies

- Record storage procedures

- Dissolution processes

The Home for Your LLC in Texas

Registering an LLC is easy. Growing a business is hard. We’re here to help.

We offer support & services beyond those of national filing companies, including:

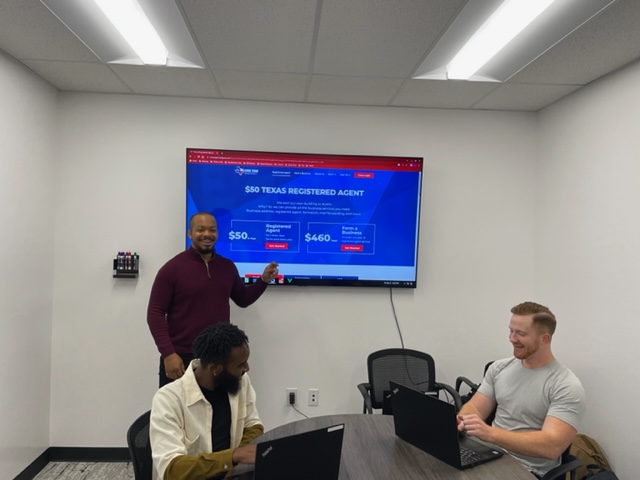

- Texas business address – we’ll give you a professional business address in our building (pictured)

- Free Texas mail scanning – 3 regular mail forwarding scans to your account each year

- Instant business identity – establish your online business identity with domain, website + SSL security, email and phone service

- Speed – fast processing, preparation and filing of certificates of formation

- Access to free LLC documents – including attorney-drafted operating agreement

- Registered agent service – we accept your state and legal mail

- Effortless compliance – compliance report reminders + renewal service at no upfront cost

- Experts – local customer support

How Much Does an LLC Cost in Texas?

Starting an LLC in Texas will cost you at least $310, thanks to state filing fees. If you use our LLC registration service, you’ll be charged $460 total, which includes a year of Texas registered agent service.

| Service | Cost |

|---|---|

| State Filing Fee | $310 |

| Our Filing Fee | $100 |

| Registered Agent Fee | $50 |

| TOTAL | $460 |

Note: Our fee includes the state filing fee and registered agent service.

Easily Maintain Your LLC Compliance with Texas Renewal Service

Every year, Texas companies become inactive because the owners forget to file required compliance reports. Getting your company back into good standing after it becomes inactive is a frustrating process involving extra paperwork and late fees.

When you’re our client, we send real-time reminders when your Public Information Report and Franchise Tax Report is approaching, so you never need to worry about forgetting. We’ll also file for you for $100 plus state fees, as part of our Renewal Service. If you’d rather handle your own compliance reports, simply cancel Renewal Service in your online account.

Texas LLC FAQ

What are the benefits of a Texas LLC?

There are numerous benefits, but here are three of the biggest:

- Taxation: A traditionally-taxed LLC is not subject to state corporate tax, and the LLC itself does not pay taxes to the IRS. Instead your income passes through to the members of the LLC and then the income is taxed as personal income on the tax returns of its members.

- Less Red Tape: Unlike a Texas Corporation, a Texas LLC does not require resolutions to alter company operations, or hold annual meetings. It is also subject to far less record keeping, primarily because they do not issue stock. Essentially, having an LLC allows you to streamline you decision-making process and get to work!

- Asset Protection: One of the huge advantages of having an LLC is that it legally separates the assets of the company from any of its member’s assets. This is done by designating what assets/debts actually belong to the LLC, and what is yours. Responsibly keeping personal and LLC assets separate helps you maintain the limited liability of your company and lessens your chances of personal debts or lawsuits.

Who can start a Texas LLC application?

Anyone can start a Texas LLC. The only requirement is that you have an appointed registered agent that resides in and can be served legal documents at a valid Texas address. Whether you live in Texas or not, we’ll form your TX LLC, provide a physical Texas business address, and be your registered agent for only $460 total.

If you’ve already formed an LLC in another state, you don’t need to form a new one to do business in Texas. Instead, you’ll need to register as a foreign Texas LLC. (Here, “foreign” just means outside of Texas.)

How do I maintain my LLC in Texas?

Once you’ve formed your company, you will be required to perform annual maintenance, and you will have some hoops to jump through if you wish to change or amend any provisions in your formation documents. It is important to keep up on the following tasks so your company doesn’t run into any hiccups:

- Filing Your Public Information Report. Texas LLCs need to file a Public Information Report with the Texas Comptroller each year. There’s no fee to file this report. If your LLC makes over $2.47 million in revenue for the year, you’ll also need to file a Texas Franchise Tax Report. More information can be found at the Texas Comptroller’s website. Your first Public Information Report is due on May 15th of the year after you form your LLC.

- Keeping Your Registered Agent Service Up to Date. You will need to make sure that you have an active, dependable registered agent. If your registered agent ever changes, quits on you, or changes addresses, you will have to amend your Texas Certificate of Formation to reflect that change. We’re not changing our location anytime soon (we own the building), so with us as your Texas registered agent you’ll never have to file a Change of Address form.

- Making Changes to Your Texas Certificate of Formation. In order to change any of the provisions that are set forth in your certificate of formation you will need to file a Form 424 with the Texas Secretary of State. You will have to do this to make a change to your entity name, your registered agent, or any other stipulations you’d like to be referenced in you formation documents. Pursuant to section 101.356(d) of the Texas Business Organizations Code, any changes to your certificate of formation must be approved by all members of your LLC.

What is a Texas Trade Name?

A trade name—also called a DBA name or assumed name—is like a pseudonym for your business, allowing you to do business under a different name without forming a brand new business entity.

So if you own a shoe store called “Bob’s Boots LLC,” and you want to start selling sandals under a different name, you can create “Selena’s Sandals” as a trade name. It’ll function under the same company, just using a different name with the public. Trade Names require filing a Texas Assumed Name Certificate. If you’d like, we can file this for your for $125 plus county fees—just add on Trade Name (DBA) service at checkout.

What are the other costs of a Texas LLC?

We’ve collected the most common state fees you may encounter when forming and maintaining your LLC in the state:

- Texas Secretary of State Filing Fee – $300. If you print and file the Certificate of Formation via mail or in-person, the fee is only $300. It can be paid by check or money order made payable to “Texas Secretary of State.” The fee is non-refundable so if there are any errors or roadblocks on your formation documents, you will be rejected and lose $300.

- Texas Secretary of State Filing Fee, When Filed Online- around $310. The Secretary of State charges a roughly 2.7% processing fee for debit and credit cards, and plastic happens to be the only method of payment accepted.

- Expedited Processing Fee- $25. If you just can’t wait any longer to get your business of the ground, you can pay an extra $25 to have them move your formation documents to the top of the stack. Paying this fee means that more than likely your formation will be approved within 2 business days. You also get the option of leaving a callback number so that the clerks that approve it can call you and confirm it to you immediately.

- Pre-Clearance Inspection Fee- $50. The Texas Secretary of State also allows you to pay for a pre-clearance inspection fee along with your Certificate of Formation. This means that a clerk will look over your documents and then assess whether your Certificate of Formation is acceptable before filing it. That way if something is illegible or your desired entity name is already taken, your $300 filing fee will be returned to you and you can fix the error before you file it.

- Certificate of Amendment- $150. There is a $150 filing fee for changing the structure or organization of your LLC. If you file it online, it’s $154.05 after the 2.7% processing fees.

Local LLC Experience.

Best Year-After-Year Value.

Expect More from Your LLC Registration Service

Plenty of LLC formation services will take your money, file your Certificate of Formation, and then let your business sink or swim. Very few give you the support and the resources to establish a business identity, connect with customers, and grow your business over time.

That’s what Lone Star does differently. As your business grows, our services are here to support you. That includes a stable Texas business address, domain registration, web hosting, and much more.

The best part? Our friendly local support team are here to help you every step of the way.